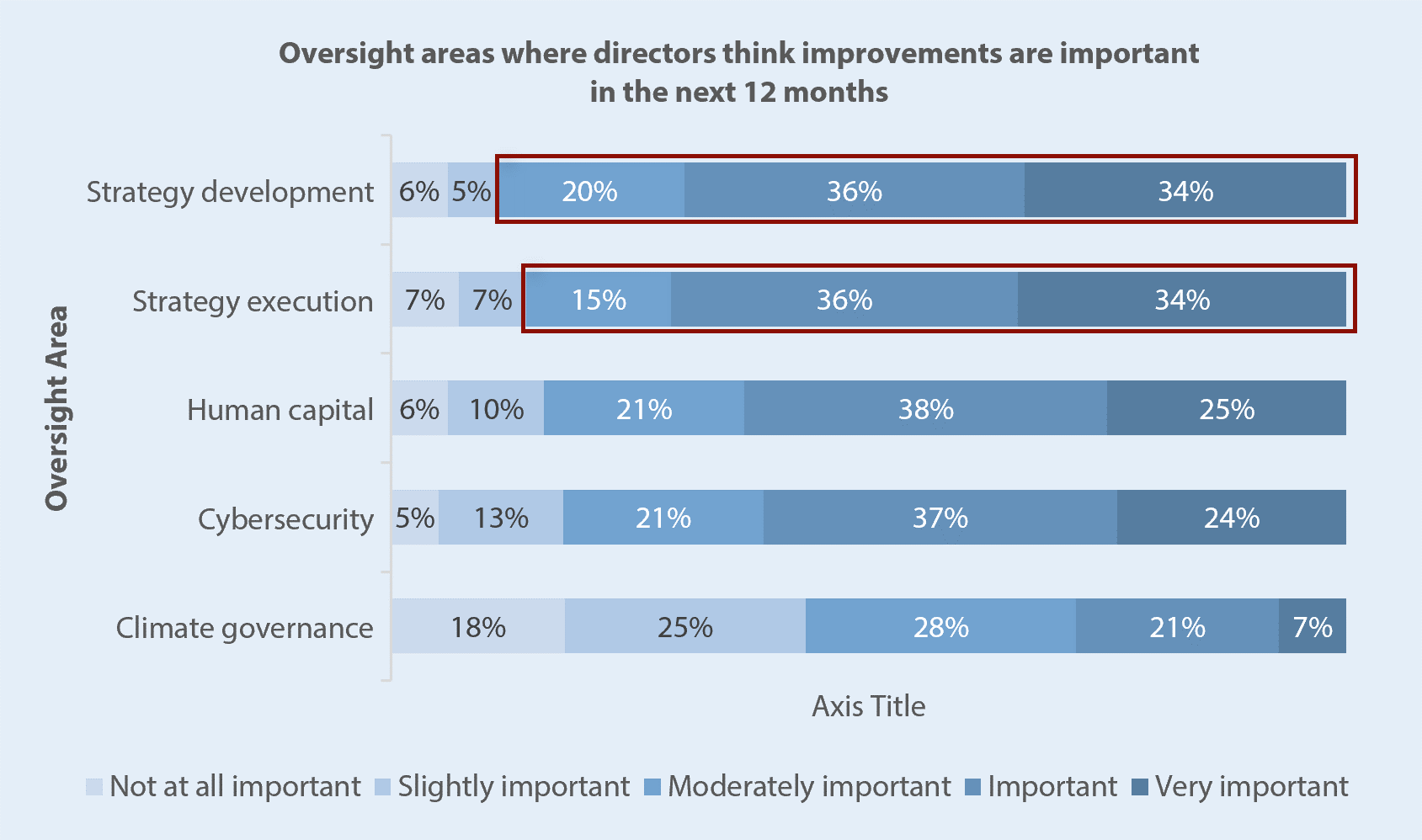

- Deloitte’s recently published “Emerging Trends in ESG Governance for 2023” report focuses on the primary oversight responsibility for ESG in S&P 500 companies

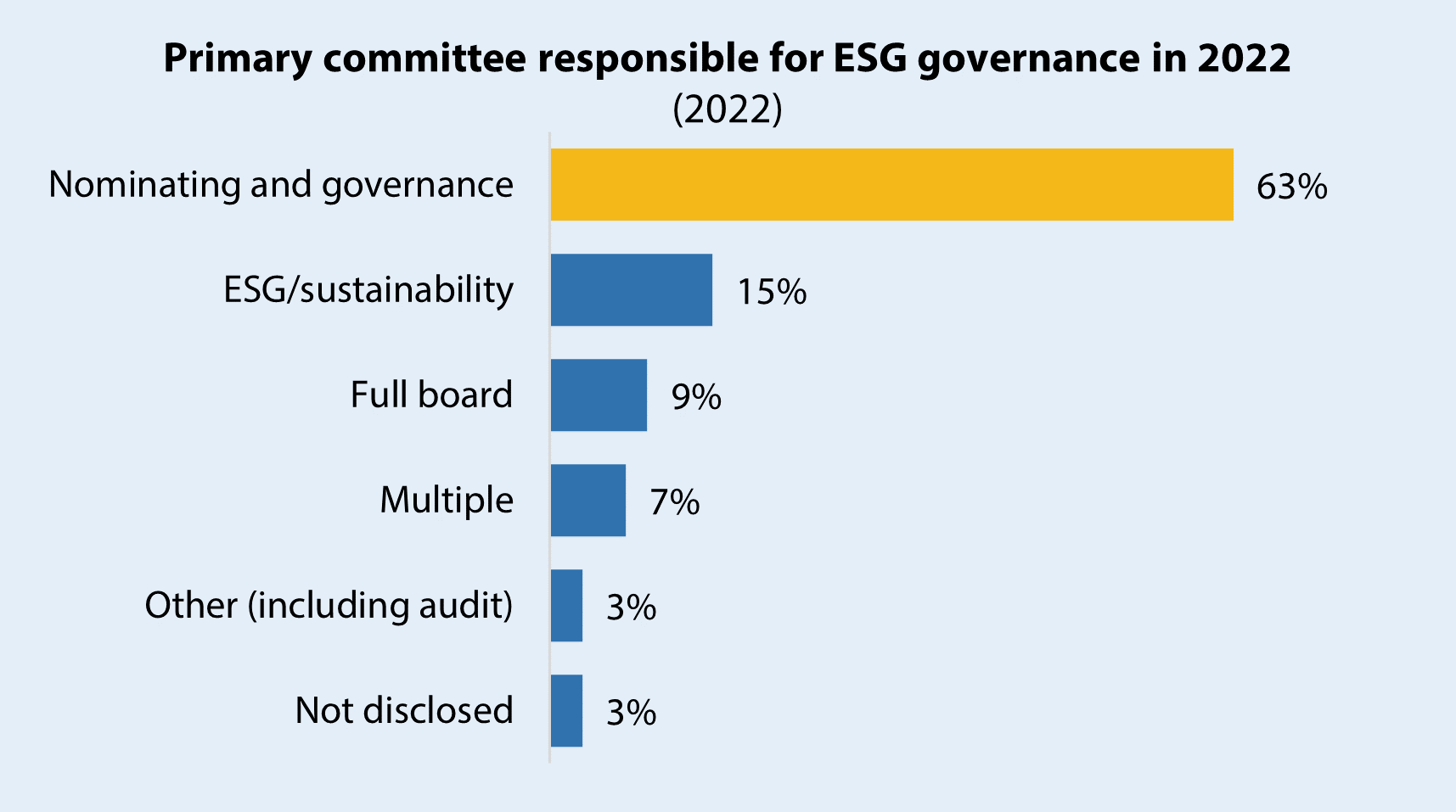

- The graph below shows the primary committee responsible for ESG governance based on proxy research of S&P 500 companies

Source: Deloitte

Key Findings…

- In 2022, only 3% of S&P 500 companies did not disclose their overall ESG board governance approach, down from 14% in 2021

- While the nomination and governance committee is commonly responsible for ESG, some companies are allocating ESG oversight responsibilities to other committees/full board

- A multicommittee/board ESG framework is on the rise with 51% of the S&P 500 companies stating that that either a) the full board combined with a committee(s) or b) multiple committees have responsibility for overseeing aspects of ESG activities

► ILMAM’s Optimal Board Program framework can help companies optimize their overall board work cycle, while considering the relevant drivers and trends