- NACD’s A Framework for Governing into the Future report published in October 2022 aims to help boards become better stewards of long-term value creation for all stakeholders

- Below are the 10 areas of the principle-based framework NACD proposes for ongoing governance improvement at both public and private companies

Source: National Association of Corporate Directors (NACD)

On Objectivity and Oversight, the report states…

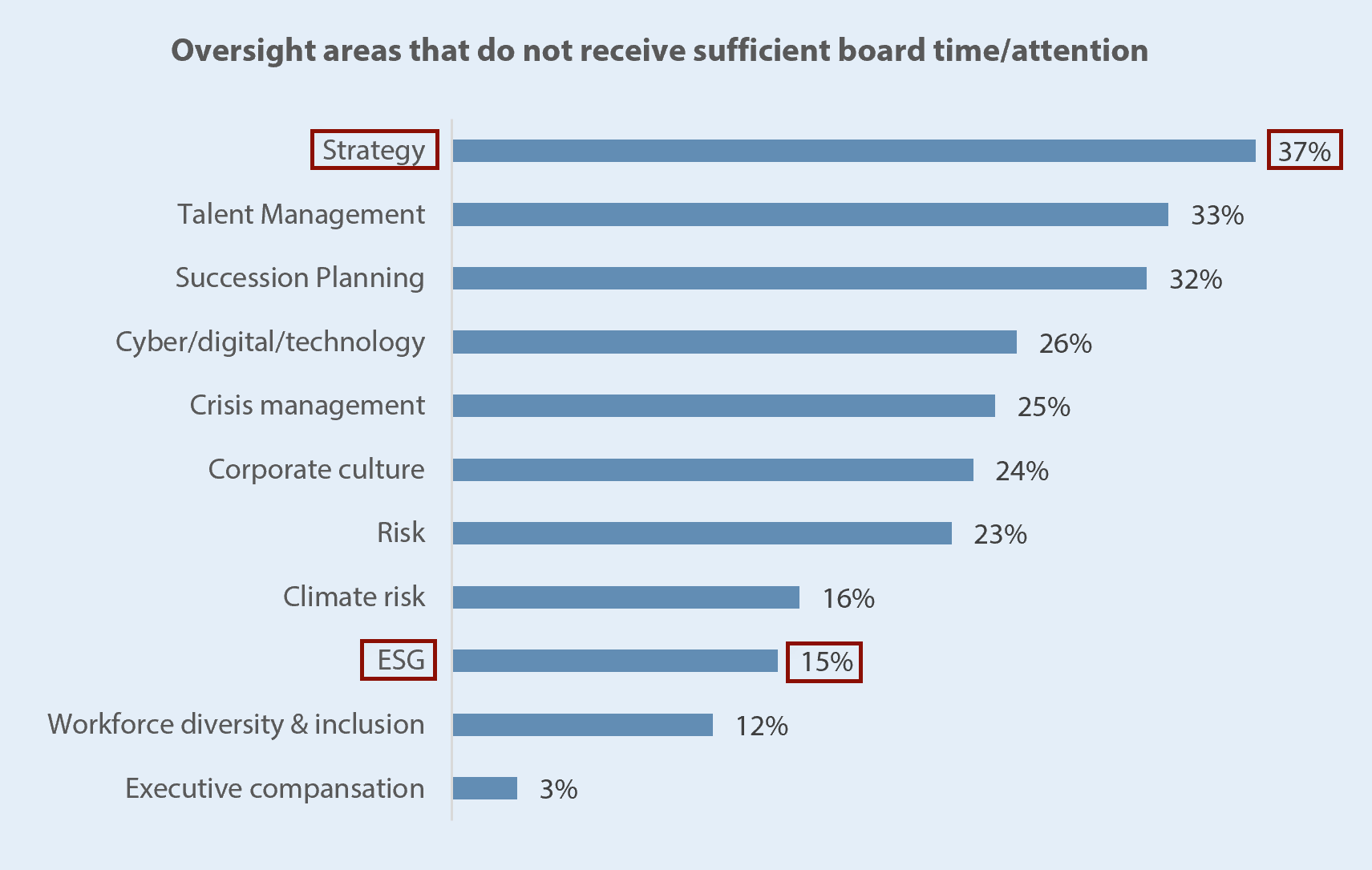

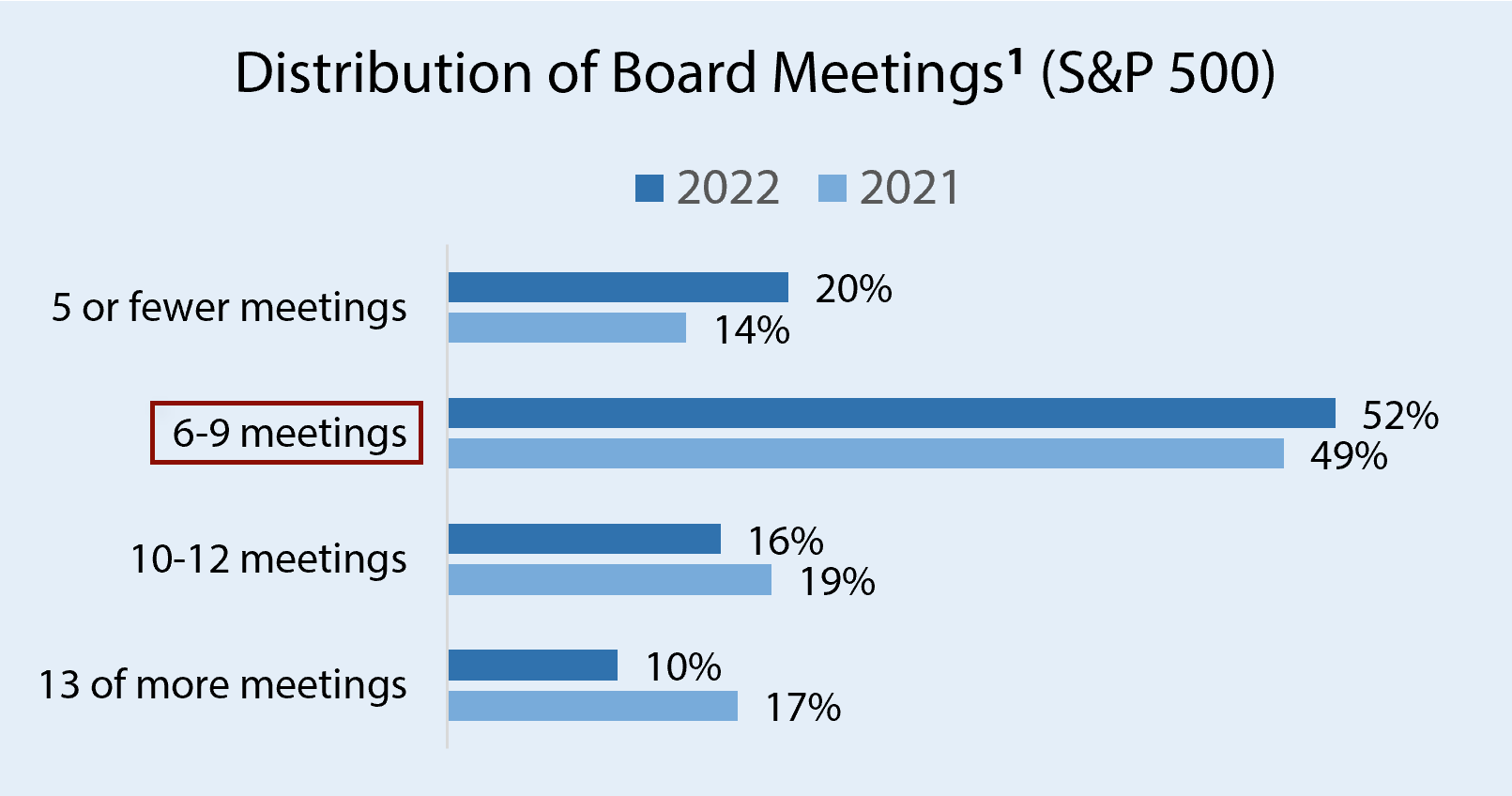

Meeting agendas should align with current board priorities and be adjusted as needed. Boards can no longer… simply rely on the formula provided by last year’s board calendar and work program.

► ILMAM’s Optimal Board Program framework can help companies optimize their overall board work cycle, while considering the relevant drivers and trends